Company per share Rs. 122 at Rs. Will issue 30 lakh equity shares with face value of 10, plans to list on NSE’s SME Emerge platform

· The funds raised through the issue will be used for setting up containerized edge data centers, setting up three admission flagship digital learning centers and for general corporate purposes.

· Mrs. Jaya Chandrakant Gogri, wife of Mr. Chandrakant Gogri and one of the promoters of Aarti Industries, holds 2.84 per cent stake in the company as on the date of prospectus filing.

Mumbai, a technology company providing services related to digital audio, video and financial blockchain (for PayFAC)-based streaming services, Varanium Cloud Ltd. has raised Rs. 36.6 crore public issue opens for subscription on 16th September.

The company has received approval to launch its public issue on the National Stock Exchange’s SME Emerge platform. The funds raised through the public issue will be used to fund the company’s expansion plans, including setting up containerized edge data centers, launching three admission flagship digital learning centers and general corporate purposes. First Overseas Capital Limited is the lead manager of the issue. The issue will close on September 20.

In the IPO per share Rs. 122 (including premium of Rs. 112 per equity share) at Rs. 10 face value of 30 lakh new equity shares will be issued at a value of Rs. 36.60 crores. The minimum lot size for application is 1,000 shares with a value of Rs. 1.22 lakhs. The retail allocation for the IPO is 50 percent. 16.2 percent of the issue size i.e. 4.86 lakh equity shares have been reserved for market makers.

Mrs. Jaya Chandrakant Gogri, wife of Mr. Chandrakant Gogri and one of the promoters of Aarti Industries, holds 2.84 per cent stake in the company as on the date of prospectus filing. In the pre-IPO placement, Mrs. Jaya Chandrakant Gogri raised Rs. Two lakh shares have been bought at the price of 99.

Mr. Harshvardhan Sable, Managing Director, Varenium Cloud Limited said, “We are a fast growing Indian technology company focused on providing services related to digital audio, video and financial blockchain (for PayFAC) based streaming services.

Varanium Cloud recognizes the existing limitations in small communities and finds digital solutions to solve them. Our aim is to reduce the technology gap by introducing new age digital tools that create equal opportunities. The company’s vision is to create possibilities and solutions through technology and break digital barriers for non-urban cities. We are confident that post the proposed public issue we will be able to execute our growth strategy in a manner that maximizes value creation for all stakeholders.”

For the financial year 2021-22, the company has invested Rs. 35.35 crore in gross receipts, Rs. 12.04 crore EBITA and Rs. 8.40 crore in net profit was reported. By March, 2022, the total net worth of the company will be Rs. 15.12 crore and the book value per share is Rs. was 23.81. The company’s shares will be listed on the NSE Emerge platform. Domestic sales for FY 2022 at Rs. 4.58 crore and export sales of Rs. 30.77 crore remained. Voice over Internet Protocol (VoIP) gross sales in FY 2022 will be Rs. 30.77 crore was contributed.

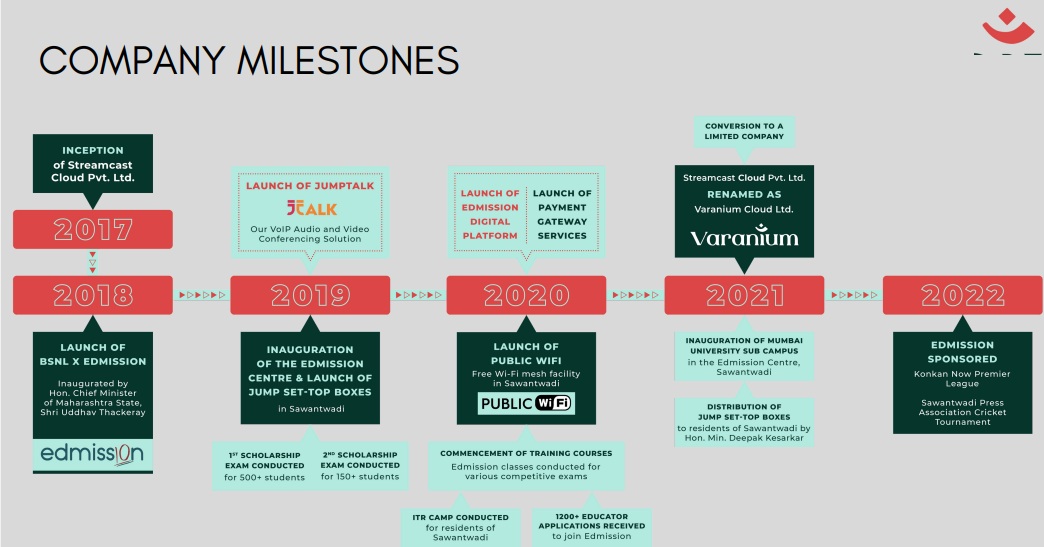

Founded in the year 2017, Varenium Cloud Limited is a technology company providing services related to digital audio, video and financial blockchain (for PayFAC) based streaming services. The company operates in the following verticals:

Providing digital audio and video content streaming services to various content owners and telecom operators in India and internationally on a SaaS (Software as a Service) model such as Voice and Video over Internet Protocol solutions (VoIP) in the BTUB and BTUC segment.

To provide Low Bandwidth Digital Education Content Platform (Edtech) with Complete Learning Management System (LMS) with focus on Non-Urban Areas under the brand Online Payment Facilitation Services (PayFAC) Admission to startups and SMEs in taking their business to digital platform and IaaS (Infrastructure Providing information technology-related services to help manage related infrastructure on an as a service) model, the company’s customers range from business owners, telecom providers, educational institutions, and in some cases to end users.

Customers for our Fee-Gital educational platform ‘Admission’ include educational institutions, private and government institutions. JumpTalk customers include resellers of mobile services as well as customers looking to avail international calling facilities in India. Finally, our offerings of Infrastructure as a Service, Payment Facilitation Services as a Service and E-Commerce, are all B2B (Business to Business) in nature and include small to large enterprises who want to leverage our services to deliver their services to their customers.